When it comes to personalisation, a study by PWC’s digital service group shows that 94% of senior-level executives believe delivering personalisation is critical or important to reaching out to customers.

In this age, almost every industry has adopted personalisation in its communication approach with customers. However, that wasn’t the case with BFSI institutions. They were primarily held back due to data privacy concerns, legacy systems with minimal automation, etc. However, due to this pandemic, in-person interactions were lost, and there was a greater need for personalisation as customer conversations turned virtual.

Rohit Ambosta,

Sharekhan

The industry needed to enable remote convenience as well as personalise their customer communication. Owing to this, the industry’s thought leaders gathered for a round table organised by Economic Times a month ago and discussed where the industry is at and where it is heading in the future when it comes to personalising customer communication.

Feel free to jump directly to any of the following sections:

- How is the BFSI sector tackling personalisation today?

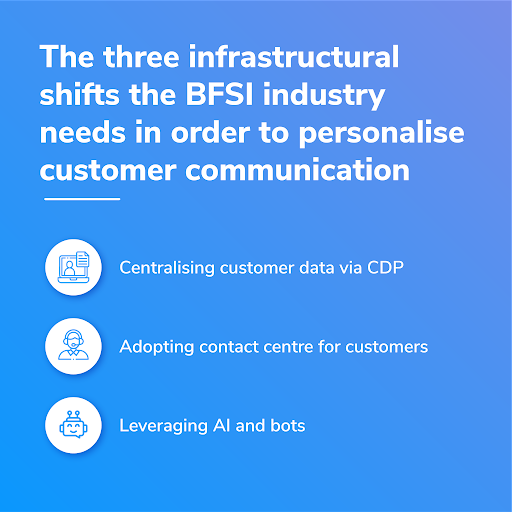

- The three infrastructural shifts to personalise customer communication:

- Centralising customer data via CDP

- Adopting contact centre for customers

- Leveraging AI and bots

- Summary

How is the BFSI sector tackling personalisation today?

In the BFSI sector, most institutions held on to the on-premise communication infrastructure as there wasn’t an agile and secure alternative. Although customer’s data was captured and tracked, it existed in silos. This lack of inter accessibility in data made it hard for institutions to personalise their communication.

Initially, the emergence of the cloud brought a level of scepticism with respect to data security as data in BFSI has always been heavily regulated. However, over time, with the emergence of encryption and top-notch data security features for the cloud model, these institutions started moving to the cloud. The pandemic has boosted the implementation of cloud across the industry, and financial institutions are now looking at leveraging the advantages of cloud telephony to personalise communication

Owing to this, most of the IT leaders we spoke to said that personalisation through AI and bots is the future. This means that personalisation can be provided in the preferred customer channels, devices, languages, etc. Let us dive deep to understand the strategies that can be implemented to personalise communication according to the industry’s thought leaders.

The three infrastructural shifts to personalise customer communication:

#1 Centralising customer data via CDP

Institutions lack visibility into customer data

Currently, BFSI institutions have a fragmented view of their customer data. These institutions have taken steps in the right direction with agile software like cloud CRMs and helpdesk, to access customer data from engagement history to account-related data, customer conversations and so.

However, the lack of interconnectivity between these data sets results in poor customer experience. For example, customers often receive calls for payment reminders from the collection teams at insurance firms despite having paid the premium. Or they are marketed to even after expressing strong disinterest against being contacted.

Shivakumar Ganesan,

CEO, Exotel

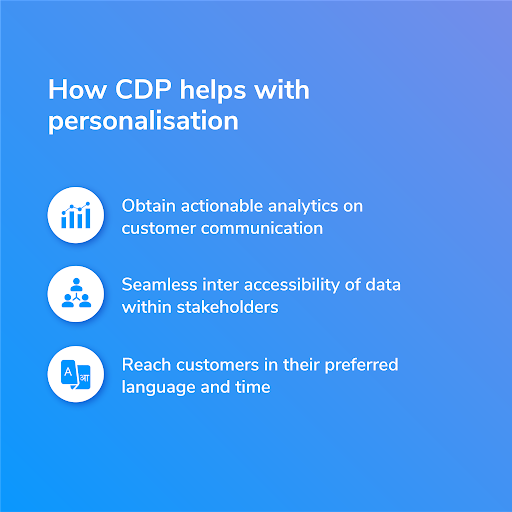

Can CDP overcome issues with fragmented customer communication data?

Suhail, from Max life insurance claims, “This is where a need for a unified customer data platform arises. When many stakeholders work on a customer journey and in instances where this data is outsourced to a partner, operations get even more complex with more systems trying to exchange information.”

CDP, a centralised platform that consists of data from a wide range of tools. The data from each tool can be tracked, analysed and managed in one platform which gives a 360-degree view of your customer data.

Here’s how CDP solves the problem arising from fragmented customer data:

- To get a comprehensive view of all the customer-facing activities; Can be used to generate analytics and reports.

- Having a CDP in place helps identify where in the funnel a customer dropped out.

- To have an elaborate view on the number of touchpoints a customer was involved in.

- It helps BFSI institutions build communication models that help transfer customer data to, and from and via partners. This enables agents to have access to meaningful data like customer history, etc, which allows them to have personalised conversations with customers.

- Institutions can reach out to the customer in their preferred language and also at their preferred time.

Ratan Kesh,

Axis Bank

#2 Adopting contact centre for customers

Reaching out to customers through the right medium

The past decade has brought about new technology and trends where customer’s preferences are constantly evolving. As customers’ preferences evolve, they expect the institutions to remember who they are, how and when they like to be contacted, etc. A preference-based approach.

This preference-based approach can be segregated into two types,

- One where the customer prefers to be contacted through certain channels despite having access to multiple channels.

- The other case is where the customer only has access to one channel.

When it comes to most rural and semi-urban areas throughout the country, customers aren’t equipped with the right devices and proper internet connection. The challenge here is to empower agents to reach out to these customers in their preferred channels and languages. As one of the panel members said, “47% of the business in the insurance sector comes from rural and semi-urban areas.” This pushed businesses to find the right channel with the right message to communicate with their diverse base of customers.

Anand,

SBI

How are BFSI institutions enabling customers through their right channel?

To tackle this, banks and financial institutions are moving towards building a customer contact centre, through which institutions would like to route all their customer interactions. Say, channels like emails, calls, WhatsApp, etc.

With a customer contact centre in place,

- Agents would have a broader view of their customer’s interactions across various business touchpoints.

- The reports and analytics from the contact centre help understand the preferred touchpoint of the customer to tailor-make further approaches.

- To find the number of channels through which the customer availed support so that solution can be provided on priority.

- Record calls and performs analytics on the data to understand the efficiencies of the agent’s interaction with the customer, which could also be used for training purposes.

- A brief overview of the calls/messages that were missed, say, the customer placed a call outside support hours can be tracked and initiated with a callback.

One of the panel members, Ratan Kesh, from Axis, claims, “The need to create communication hubs has become more important than ever as it became a fundamental part of customer experience amidst this pandemic.”

#3 Leveraging AI and bots

Anand,

SBI Life

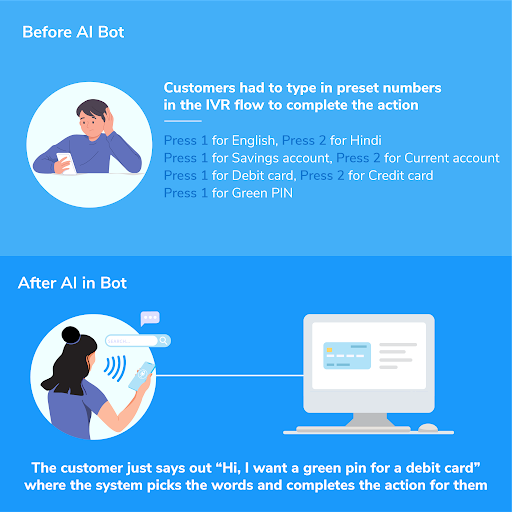

Automation through IVR and intent prediction engines:

AI and bot-based digital assistance are still in their infancy. At present, bots are static, and they don’t know everything about customers. The major contributor to the staticity of bots are the silos in data. Unstructured and scattered customer data leaves the system unequipped for all customer-facing scenarios.

Without siloed data, personalisation with AI-powered tools can be a real step up in the BFSI industry. One such case is where IVR bots can be fed with all the customer data from the CDP. When modelled with an intent prediction engine, the caller’s intent and the stage of the journey is understood. This helps to route the call accordingly without any manual input from the customer.

Ratan Kesh from Axis Bank showcases an example of how to boost CX without any manual actions from the customer

Sentiment analytics for spontaneity :

Ratan Kesh,

Axis Bank

For example, when a customer is in conversation with a bot and sounds frustrated, or the customer enters repeated inputs via IVR, a live agent can barge in and take over the call. This way, the agents can focus on helping customers that need it the most, and leaving the rest to bots. This can help reduce manual effort and also boost CX, as customers who are in dire need of a resolution would be relieved to have their issues solved by an actual agent.

Summary

The future looks promising for the BFSI sector when it comes to personalisation, thanks to the pandemic that quickened the shift. However, there are a lot of infrastructural shifts that need to take place to make this happen. To get the best results, BFSI & NBFC institutions need to create and implement a holistic strategy instead of going ahead with a siloed approach.

The panel members agreed that the aim is to personalise the experience, but it’s a good practice to always keep humans in the flow because meaningful solutions are created when humans and machines work together, as humans come with emotional intelligence that bots lack.

+60-3-2771-2799

+60-3-2771-2799 +91-8088919888

+91-8088919888 +1-(718) 354-8866

+1-(718) 354-8866 +62-215-098-4960

+62-215-098-4960 +65-6951-5460

+65-6951-5460 +61-2-8073-0559

+61-2-8073-0559

zoritoler imol

I’m not sure exactly why but this site is loading incredibly slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later and see if the problem still exists.