“I miss visiting the branch of Axis Bank to interact with the folks I know over there for years,” said Shivakumar Ganesan’s mother, when the pandemic locked down the country early last year.

Shivakumar is our CEO, also fondly called Shivku. His mom continues, “Still, I’m happy that I can connect with them over the phone anytime,” prompting him to share this anecdote with the panellists at a recent virtual roundtable that we co-organised with The Economic Times. The panel at the roundtable discussed how communication in financial(even NBFC) service institutions has evolved and the challenges they encountered along the way. Additionally, they offered a sneak peek into how they expect technology to support evolving communication models.

Shivku, building on the anecdote, wondered how a bank can offer the freedom of channel choice. This is in light of targeting customer segments covering age groups from boomers, mid-aged Gen Xers to younger millennials. While industry panelists from the likes of Ratan Kesh, EVP and Head of Retail Operations at Axis bank and Rohit Ambosta, CIO at Sharekhan agreed, that was one of many challenges (listed here) that the industry as a whole has been trying to overcome since the pandemic upended traditional communication practices.

To help you find exactly what you are looking for, jump to any of the following sections:

- Pandemic-Influenced Communication Challenges in Finance

- Industry leaders share current best practices to optimise customer engagement

- Unpacking Future Building Blocks for Effective Customer Engagement Strategies

Pandemic-Influenced Communication Challenges in Finance:

1. Workforce Engagement Practices Are Found Wanting

Retaining customer trust in this industry is crucial for players to ensure long-term customer relationships. The biggest concern on executives’ minds was how to keep trust levels high with a workforce that went remote almost overnight.

Suhail Ghai, EVP & CTO at Max Life puts it well – ‘It was mission-critical to have offline agents deliver online experiences sooner than later.’ Tactically, institutions from Max to SBI Life built microsites specifically for prospects to self-discover products. In addition, e-cards, digital profiles and quote engines were developed for better sales assistance.

But there were other higher process-level changes that took longer to standardise engagement practices. In fact, some of them are still underway as organizations reconfigure themselves to engage the now fully remote, digitally-equipped customer.

Shivakumar Ganesan,

CEO, Exotel

2. Changing CX Needs Not Matched by Tech

The pandemic forced financial enterprises to quickly migrate towards digital-first and digital-capable customer engagement models. This was either by patching the on-premise solution to their agent’s devices or exploring cloud tools. But there were concerns around adopting cloud solutions given an underlying fear that confidential financial data of customers could be compromised.

Rohit Ambosta,

CIO, Sharekhan

3. Disconnected Customer Communication

Financial institutions have adopted new digital channels to meet the shifting communication preferences of customers. Sadly, the downside of this shift is siloed communication. Agents are now communicating with customers on multiple channels but every time a customer switches channels, the context and trail of previous conversations are lost. This prompts agents to ask the customer to repeat their concern or query from scratch, leading to poor customer experiences and longer turnaround times for resolution.

Therefore, there is a need for a central system to process data from all the communication channels used and connect the dots. Teams across multiple departments must be updated of the progress of conversations happening across the respective departments, to offer a unified approach towards case resolution. This will help predict future customer needs and suggest personalised responses. Thankfully, BFSI enterprises are already working towards making this the norm sooner than later.

Case in point: Ratan Kesh shares how Axis bank built a CRM that could be directly accessed on the mobile devices of the bank’s 50,000 odd sales executives selling from home.

4. Speed of Engagement Takes a Hit

We have seen automated engagement begin in fits and starts through ready-to-deploy chatbot capabilities. Think of channels like private or social messaging apps that you can interact it with a few thumb taps. But a siloed approach to automation still hurts the pace of engagement expected by today’s savvy customers when customers shift their conversations to a more traditional channel such as a voice call or email. Today, they are well accustomed to automated, contextual engagement offered by the Zomatos and Olas of the consumer business world. And when one channel cannot automate repetitive queries, to begin with, it slows down the entire process of customer communication.

Industry Leaders Share Current Best Practices To Optimise Customer Engagement

1. A Robust Communications Framework

A host of digital channels are being used to meet the customer on their preferred channels along with the right context needed to take the conversation forward. To prevent scenarios where agents ask customers to repeat the query at every new touchpoint with the business, a Communications Platform as a Service (CPaaS) is required. Essentially, it is an Application Programming Interface (API) framework connecting multiple channels (in fact even offered by Exotel) which can work with a modern cloud contact center to create:

- Better omnichannel customer engagement

- Faster response and resolution rates

- Better integration with other key tools

This is why we brought Ameyo on board, a leading omnichannel contact center solution that offers cloud, on-premise or hybrid end-to-end capabilities to meet support, sales or operational needs of the modern enterprise today. It works seamlessly with a constellation of channels connected through the CPaaS framework allowing agents to respond in real-time. It suits the customer preferences to converse with your business through social media or your site’s chatbot.

2. A Unified Customer Data Hub

A key advantage of any digital tool is its analytical capabilities. Rapid digital transformation has created a lot of data, mostly unstructured and messy for data scientists to make sense of. A customer data platform (CDP) offers a comprehensive and organised way to gather, store, manage and share customer data with the entire enterprise for various use cases.

Shivakumar Ganesan,

CEO, Exotel

3. AI-Driven Customer Engagement

An intelligent layer must work with the communication framework and the contact centre to achieve these goals:

a. Smart bot automation: Your customers are very familiar with the pace of dispute resolution or contextual responses offered by the Amazons and Ubers of the business world. Today, they compare these apps and services with yours. Once channels and platforms are connected, tech teams can create automations to work in tandem with AI. Then, the AI can personalise suggestions to offer more desired responses or respond to static, repetitive queries. Both can help boost CX levels significantly.

b. Contextual responses: Smart analytics can now even monitor customer sentiments not directly noticeable to agents. It extracts call data from the cloud telephony app, or from key customer responses through the website’s chatbot product.

Suhail Ghai,

EVP (IT) & CTO at Max Life

c. Real-time agent assistance: Ratan Kesh from Axis Bank predicted how communication systems must be capable of allowing call listening and intervention capabilities, with the ability to integrate well with AI and automated models. This translates to active listening of agent calls in real-time using speech-to-text models and natural language processing (NLP) to understand the tone employed by customers and agents. The AI can then whisper suggestions to resolve or address the ongoing query or decide when a supervisor needs to intervene in the call.

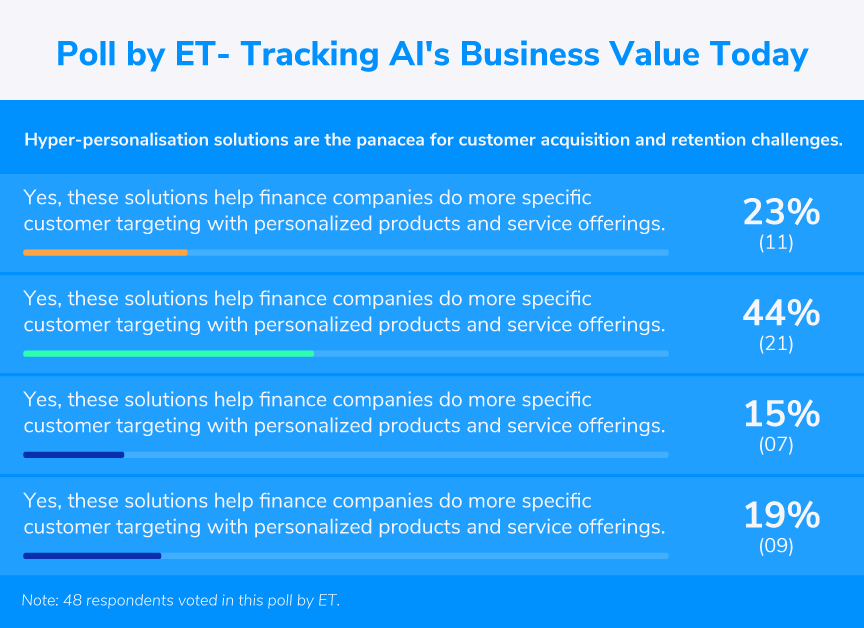

A poll by the Economic Times’ moderators conducted during the webinar

Unpacking Future Building Blocks for Effective Customer Engagement Strategies:

1. Taking Conversational AI Mainstream

Conversational AI occupies gaps in your communication workflows where agents cannot respond quickly or at all. It complements, not conflicts with an omnichannel approach. In fact, the latter needs live agents manning key channels while conversational AI can begin the conversation and apply a level of intelligence and automation. It can do this by gathering actionable insights from the CDP. The CDP, to recall, captures and organizes this by tapping into customer context from the CRM and tracking insights from the CPaaS framework of channels.

Suhail Ghai,

CTO, Max Life Insurance

2. Strong Cross-Journey Customer Context

A full-fledged customer engagement offering can easily offer expected engagement levels, and that is something Exotel is putting together quickly. For instance, our industry-leading CPaaS is now being integrated and unified with Ameyo’s cloud contact centre as a service (CCaaS).

We’re not stopping there, but layering them with a CDP that becomes the single source of customer truth that works seamlessly with key customer-facing tools like customer relationship management or helpdesk apps. The final piece in the puzzle is to build out a nerve center that adds sentiment analytic and AI capabilities to personalise engagement. Businesses can operationalise and deliver this at scale with chatbot capabilities to respond and engage with any number of customers at the same time, taking up responses to routine queries by itself and offering personalised responses through the feed from the CDP’s nerve centre.

The pandemic is the biggest accelerant for digital transformation but the adoption of digital tools and systems has to be done in a systematic manner. This is significant especially when it comes to the confluence between your business and your customers – communication strategies. Our recent acquisition of Cogno AI, a conversational AI tool that is used by leading BFSI businesses across Australia now fills another key piece in our march towards building the emerging market’s first-ever AI-powered cloud customer engagement platform. Read all about our vision and book a consultation to find out how to streamline your business communication strategy.

Ebook: Cloud Telephony for BFSI

During the lockdown, a lot of organisations have realised that moving to cloud telephony has more benefits than just enabling remote work. This ebook offers an insight into how cloud telephony helps solve some of the most common problems faced by customer-facing teams in BFSI.

No Comments